Deals+ O&G Deals Done in the UK Q1 2020

As featured in Energy Voice, Anderson Anderson & Brown Corporate Finance (“AABcf”) are delighted to share our quarterly Deals+ update for Q1 2020, highlighting selected Oil & Gas M&A and Fundraising transactions across the UK. Reflecting on Q1 2020 With the…

Blog5th May 2020

As featured in Energy Voice, Anderson Anderson & Brown Corporate Finance (“AABcf”) are delighted to share our quarterly Deals+ update for Q1 2020, highlighting selected Oil & Gas M&A and Fundraising transactions across the UK.

Reflecting on Q1 2020

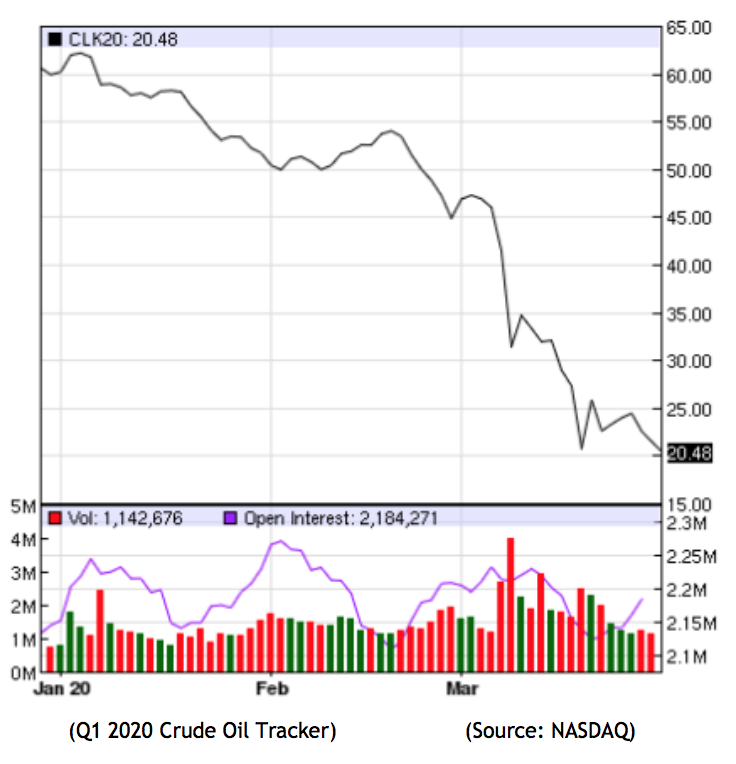

With the COVID-19 pandemic wrecking havoc globally, financial markets faltering and a geo-political oil price war unfolding it is clear that we are in unprecedented times that are proving far more sinister than could ever have been imagined at the beginning of the quarter. The damaging price war between Saudi Arabia and Russia and increased OPEC production (despite a global reduction in demand) have all forced undue pressure on global equity and commodity markets squeezing Majors and independents with Brent Crude trading at decade lows of c.$20 p.b and WTI futures trading negative for the first time ever.

From an M&A perspective activity has slowed as the equity markets continue to assess the impact of the pandemic and businesses focus on conserving cash and tapping liquidity in the short-term. As such, we expect to see creative and innovative deal structures continue in the Upstream market where crippling CAPEX budgets and shrinking cash-flows will force a wave of consolidation with many expected to struggle in this unchartered environment. Despite the strong headwinds presented in recent weeks, the trend of Majors divesting of non-core assets continued in Q1 2020, with deals including Premier Oil’s £475m acquisition of BP’s interests in the Shearwater and Andrew fields.

The Energy Voice coverage can be viewed here.