Making Tax Digital for VAT: MTD-Day minus 200…and counting

It’s a bit like GDPR – everyone’s suddenly talking about Making Tax Digital for VAT (“MTD”) but many businesses don’t know what it means and how it impacts them, let alone what they might have to do. So, let’s ask…

Blog29th Jun 2018

It’s a bit like GDPR – everyone’s suddenly talking about Making Tax Digital for VAT (“MTD”) but many businesses don’t know what it means and how it impacts them, let alone what they might have to do.

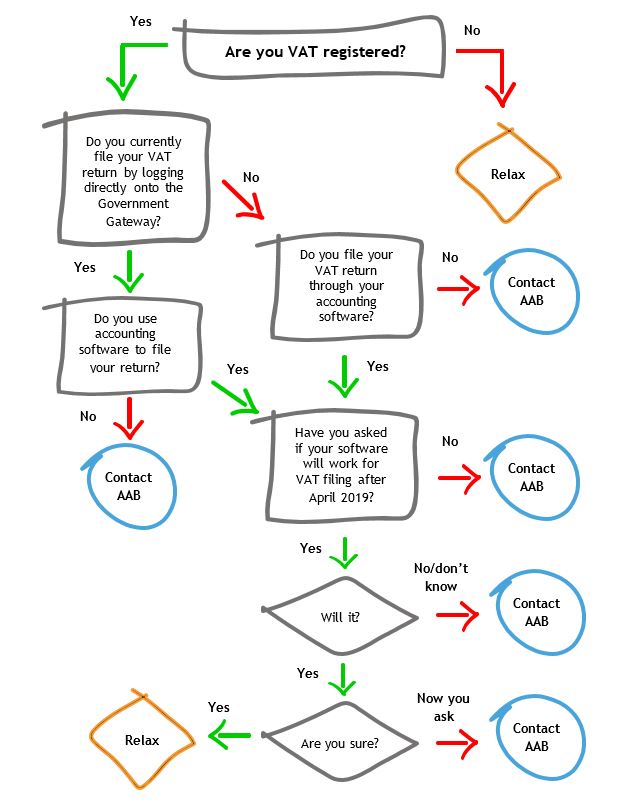

So, let’s ask a few questions:

Question 1 – What is MTD for VAT?

Put simply, from April 2019 (i.e. less than 200 working days to go as I write this…), if you are VAT Registered with turnover greater than £85,000 you will no longer be able to log onto the Government Gateway and submit your VAT Return

Question 2 – How will I submit my VAT Return then?

You will have to do this through (technical term coming up) ‘functional compatible software’

Question 3 – What does that mean?

Old versions of accounting software may need to be upgraded, manual systems will have to be changed to digital

Question 4 – I’m using software already – won’t it work next year?

There isn’t a list available yet of software which will work. The technology is still being developed, and although HMRC is currently working with software providers the list won’t be out until later this year. But we do know that some software providers have already said they won’t be updating old versions of their software

Question 5 – So how do I know what to do?

Go through our MTD outline below, it will help you identify if you are going to have to do something to become compliant. You will have options and it is a great opportunity to evaluate what you are getting from your existing system and consider whether you could benefit from moving to one of the newer platforms.

We want to help you make sure you get the most out of any software changes which you may have to make. It’s not just about meeting HMRC’s requirements on MTD-Day; we have helped many businesses benefit from the enhanced efficiencies and reporting available, particularly using cloud-based software. So, don’t hesitate to contact us to find out how AAB can help you understand – and get the most out of – Making Tax Digital.

For more information contact Hilary Dyson, Cloud Accounting Manager, (hilary.dyson@aab.uk) or your usual AAB Advisor.